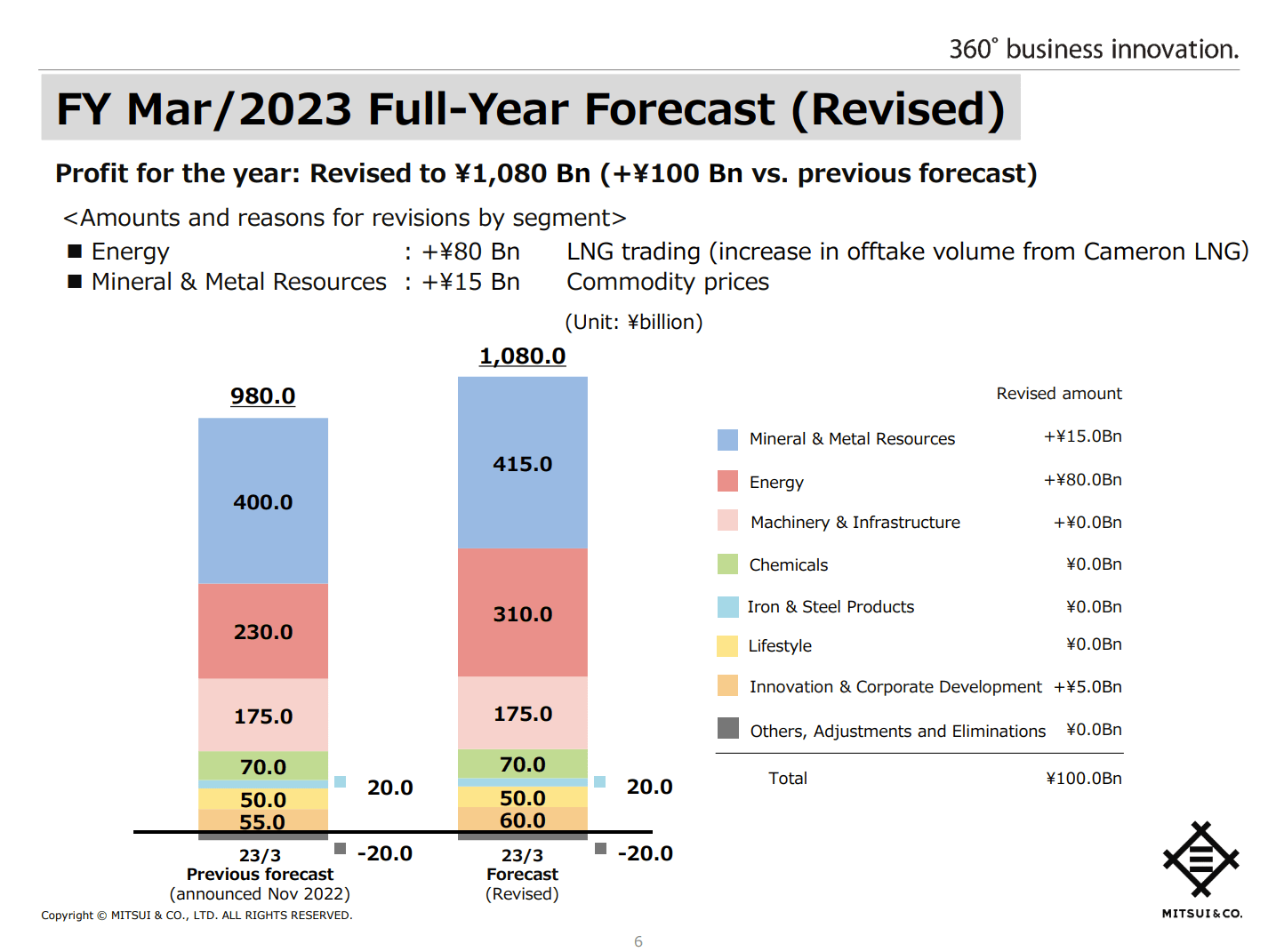

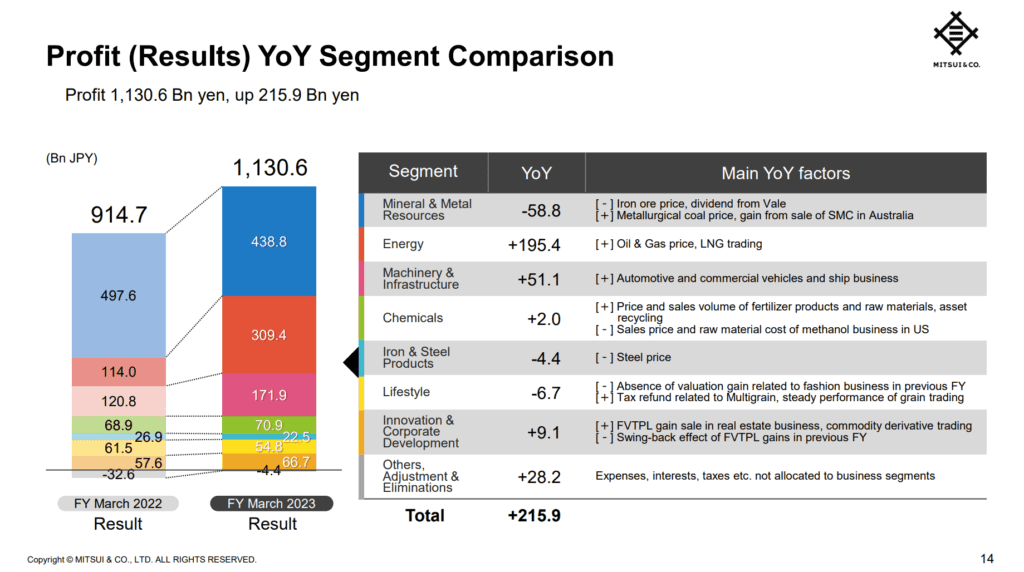

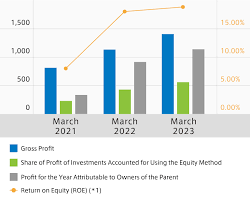

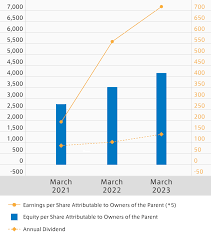

When Warren Buffett visited Japan in April 2023, he publicly announced that he would “increase the percentage of shares held in the five major general trading companies.” About a year has passed since then. The stock prices of each company are on the rise across the board, reaching new highs since listing. Mitsui & Co.’s final profit for fiscal 2023 was 1,063.6 billion yen (announced on May 1), and Mitsubishi Corporation’s profit was 964 billion yen (announced on May 2), the second highest level ever for both companies. , each generated a profit of around 1 trillion yen.

What is the reason why trading companies continue to make rapid progress? Daisuke Ueno, who himself used to work at Mitsubishi Corporation and also has a background at FamilyMart, an ITOCHU Corporation group, will publish the secrets to the strength of trading companies that he introduced in the “Fearless Career Strategy” section of the Forbes JAPAN newsletter.

Trading company personnel are super generalists

Previously, I wrote that one of the secrets to the success of a general trading company was the business investment that Bloody Information made at no cost. Bloody information is information that spills blood, such as “The quality of Company A’s products has deteriorated,” “Payment from Company B is delayed,” or “The ace from Company C has changed jobs to Company D and came to say hello.” It is the vivid information that can be obtained by immersing yourself in the industry’s commercial flow with such determination.

So, how do trading company personnel who are on the front lines of business, who obtain this information every day, turn this information into “earnings”?

If you break down their powers, there are exactly three.

One is a business spirit with a sense of scale. In any case, trading company personnel are always on the lookout for opportunities to make money. I used to work in the media department, and I even went there to sell copy paper used by companies in which I invested (I even negotiated to have Lawson, a group company, in the convenience store on the first floor of the office).

While always keeping this kind of antenna up, what is very important is a “business spirit with a sense of scale.” There is a mentality that if you want to make money, you have to make billions of yen or you won’t fit in with the company’s size. Personally, I believe that this is the clear difference between startups, which may end up as small businesses, or small and medium-sized enterprises that do not aim for aggressive expansion, and general trading companies, which continue to grow even after becoming super-large companies. .

The second thing, which may come as a surprise, is to be a super generalist. A trading company person has deep industry knowledge that allows them to grasp first-hand information, while also having basic skills in accounting, finance, legal affairs, and taxation, as well as being able to handle everything from sales, negotiations, and entertainment.

When I was a new employee, I used Yayoi Accounting to do the closing work, thinking, “You should do it,” because there was a shortage of manpower at the investment company. There were some people who completed their tax returns on their own).

Mitsui: When you combine your business spirit with your generalist skills

In this way, by doing things yourself out of necessity, you will accumulate a wide range of business skills. When you combine your business spirit with your generalist skills, you will be able to see a single project more three-dimensionally and draw up various schemes. Consultants are strong in PL, and investment bankers are strong in BS, but it is trading company personnel who understand PL and BS and are able to act as players themselves.

Third, the great power that trading company personnel have is “footwork on the earth”. A general trading company that generates profits on the order of 1 trillion yen needs to aim for projects worth several billion yen in each department. When a project generates a profit of several hundred million yen, it is often said that the project does not fit the scale of a trading company.

However, if you want to be the first to find a deal worth billions of yen, there’s no way you can find it while sitting in your office or at your desk! (Maybe you can’t find it on ChatGPT either). When that happens, I travel all over Japan, or even around the world, meeting people all the time to get information about their blood. Of course, as you might imagine (?) there are some people who eat out every night. Rather than scrutinizing the projects of acquaintances or those that are brought to us, we seriously travel the world on our own and continue to pursue the best earning opportunities.

I feel like this is what is most sought after in Japan right now.Last spring, my boss from Mitsubishi Corporation retired, and we held a small party to celebrate. I thought he was going to take a little summer vacation and relax, but he handed me a business card of the company he would be joining next and talked about his plans to form a joint venture with an overseas company. “Ueno, don’t focus on the marketing field, and study more about finance and accounting,” he advised.I was truly reminded of the scale-based business spirit, super generalist, and global footwork of my senior colleagues at a trading company.

Iron-clad risk management

In addition to the three powers of a trading company person who makes money, I would like to share with you the important functions that a general trading company has.In fact, behind the overwhelming profits is the ability to quickly retreat from losses. Although he is a trading company person who aggressively pursues investment opportunities while gaining a variety of information in the business flow, you might think that he ends up investing in this and that. In fact, in the 1990s, when general trading companies shifted from a trade transaction model to a business investment model, they suffered many hardships due to their sloppy investments.

From this point on, each trading company worked to establish an investment function by thoroughly researching American-style portfolio management and the risk management that supports it, while also using strategic consulting. The strength we have developed through this process is our “iron-clad risk management,” which goes hand-in-hand with aggressive business investment that leverages the information we have.The number of companies other than general trading companies that invest in businesses has increased, but when I hear about investment risk management, I feel that there is a gap of about 30 years (that is, the 90s for general trading companies) from general trading companies. .Let me give you an impressive example of risk management.

When I was working at Mitsubishi Corporation, I was surprised by the “EXIT rule.” This is a rule that if a company’s credit rating goes down or it continues to be in the red for three years, it will withdraw from the business.In the investment decision proposal, we were asked to describe potential sellers in the event that we withdraw from the business in the future, the impact of regulatory laws, and the treatment of assets such as personnel and factories.As a newbie, I wondered, “Why do I have to write down backward-looking instructions on how to exit when I’m excited to make an investment decision?” But now I understand the importance of the “EXIT rule.” I feel that.

Many companies are unable to separate their existing businesses from the past and continue to maintain them. That’s to be expected, and since I haven’t decided how to retreat, I can’t judge. Behind the scenes of general trading companies being able to aggressively seize investment opportunities based on the information available to them, the driving force behind this is the scenario of how to exit when things don’t go well.

General trading companies, which are business entities created by the resource-poor island nation of Japan through the wisdom and sweat of the Japanese people, are now earning trillions of yen in profits on a global scale. Although it may be difficult to create GAFA (M) from Japan, it may be possible to create the next general trading companies. Now is the time for Japanese companies and Japanese people to learn from general trading companies and trading company personnel!

Must Read: “Tesla’s new low-priced car” 3 Models has divided analysts’ views